All information corresponds to the second half of December 2025. This page or the data on it is not updated, unless otherwise indicated.

Table of Contents

Open Table of Contents

- 2025 Was a Boring, Steady Year

- Issuance Grew Quietly without Any Bigger Drama

- More Issuers than Last Year but Potential Winners are Easier to Spot

- Payments Volume and DeFi Usage Have Increased

- Issuers Are Starting to Look For Opportunities Beyond Simple Issuance

- 2026 Will See Further Consolidation with First Banks Starting to Chip at the Prize

- Key Takeaways

- Closing Notes

- Recommended Reading

- Appendix: List of Euro Stablecoin Issuers

2025 Was a Boring, Steady Year

50%. That’s how much the euro stablecoin market capitalisation grew in 2025.

Last year I predicted that euro stablecoins would not grow relative to USD. This seemed to be pretty much spot on as both total USD and EUR stablecoin supply grew approximately 50% year-on-year. We also saw announcements of new issuers and a few new euro stablecoins get launched (e.g., EUROD, EUR0), as predicted.

The reason none of the euro stablecoins took off this year (either), still seems to come down to demand and utility dynamics. While Europeans were woken up by realised fx-losses with USD/EUR moving from 0.97 to 0.85, few shifted their stablecoin holdings to their own unit of account. The utility of USD stablecoins continues to dominate with much greater interoperability, liquidity, and yields.

Bank stablecoins, such as EURI from Banking Circle, EURCV from SG-FORGE, and EUROD from ODDO have not been any more succesful, even though EURCV has interestingly started making forays into DeFi. More bank stablecoins have been announced and the European market seems to be becoming much more tightly intertwined with the legacy financial system than its US counterpart.

On the other side of the spectrum, the non-regulated euro stablecoin market share has continued to shrink.

Issuance Grew Quietly without Any Bigger Drama

Second Half of the Year Contained Interesting Announcements

Before the data based analysis, let’s speedrun the most important news of 2025:

Again, the first half of the year was very quiet. No new major announcements, features, integrations. This seems to be becoming a recurring pattern where H1 is the nothing-ever-happens-half. If something has to be mentioned, Paxos completed the acquisition of Membrane Finance and the Council of the European Union published a (literal) non-paper on EU and third country stablecoin multi-issuance.

The non-paper is an excellent summary read on the most important issue facing European stablecoins. Expect multi-issuance, the practice of simultaneously issuing a fungible stablecoin from multiple jurisdictions with different rules, to be a top discussion point in 2026. In regard to USD stablecoins, it concurrently distorts competition, reduces consumer protections, and improves interoperability by allowing non-EU issuers to move reserves out of the EU and chase higher yields and lower cost structures.

In September EURCV expanded into DeFi by deploying a Morpho instance where Spiko’s tokenised EU govvies could be used as collateral to borrow EURCV. Eligible EURCV markets have since expanded into BTC, USD, etc. Nine European banks announced their intention to jointly issue a stablecoin through ”Qivalis“.

In October Alipay received a licence to issue a stablecoin, one that purportly is to be used only for wholesale purposes. Usual Money launched a Euro stablecoin, EUR0, backed by Spiko’s govvies.

In November, Bancomat joined the growing cadre of established European financial institutions in the stablecoin game by announcing its intention to issue its own stablecoin. Both Bancomat and Qivalis launches are scheduled for H2/2026. The ECB published a slightly cautionary piece on stablecoins. EURt redemptions ended. Monerium froze, without any NCA request or judicial proceeding, 1.3m EURe following Balancer hack.

In December, EURC expanded onto World Chain.

Like this article so far? Help others discover it by sharing it in your network.

Data Shows Growth Across All Metrics

The data presented below is based on multiple on- and off-chain sources and has been worked on over multiple weeks to find interesting data insights. You can browse some of the data presented below here.

Issuance Grew by ~50%

Total issuance grew ~50% from €320m to €490m. If we exclude issuer-controlled and idle funds, defined as euros in circulation but in issuer wallets and euros that have not been used or have sat dormant for 1y+, respectively, total issuance is closer to €360m.

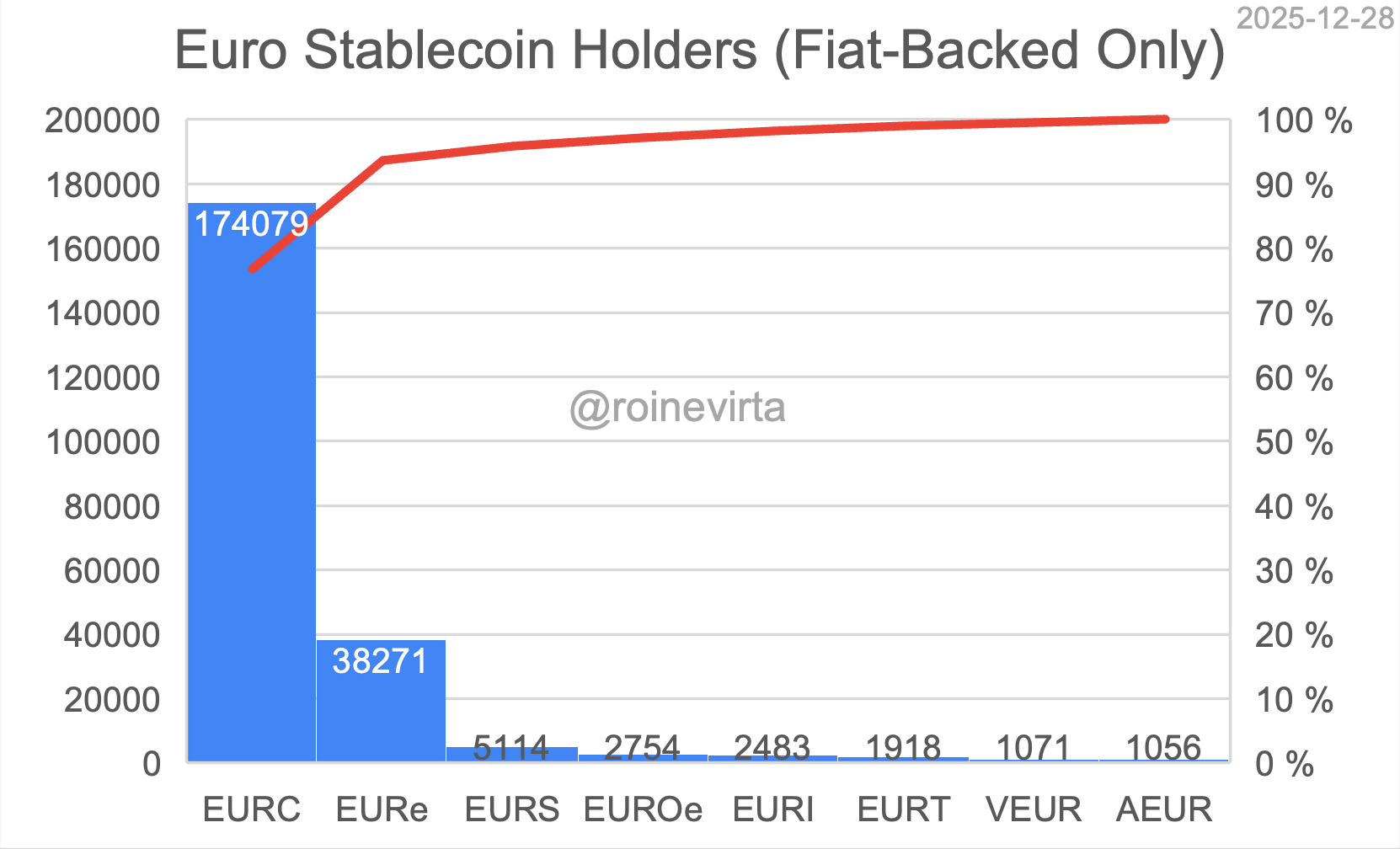

Holder Counts Significantly Higher than Last Year

Euro stablecoin holder count has increased significantly to ~1.4m addresses across all blockchains and stablecoins. This is primarily driven by EURA from Angle whose stablecoins have over 1.1m holders. The second place goes to EURC with 174k holders, followed by EURe with 38k.

Interestingly, the holder count of EURA comes down by approx. 50% and EURC by 25% if we exclude addresses with less than 1€, indicating large dust balances in those assets.

Last Year’s Composition Trends Continued

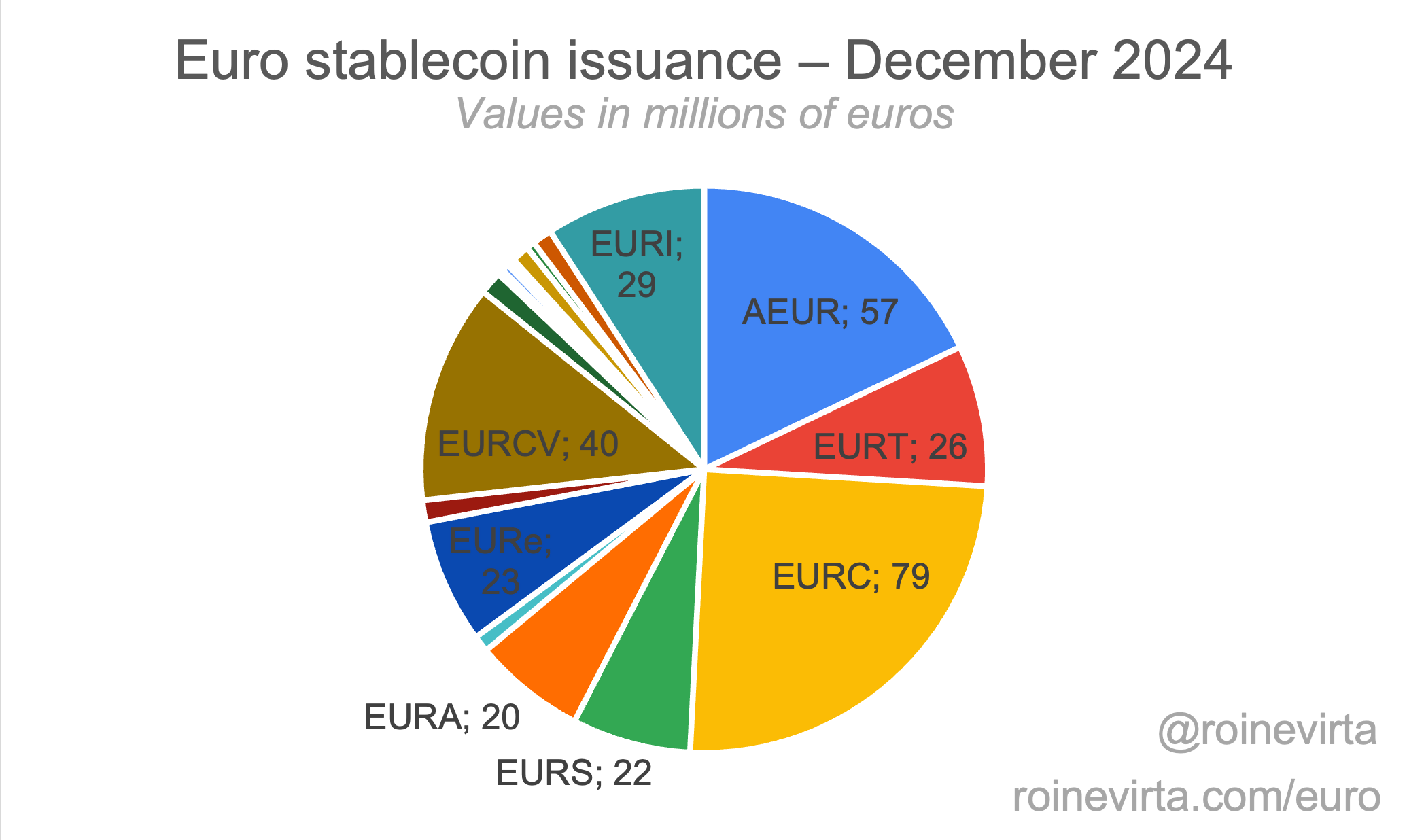

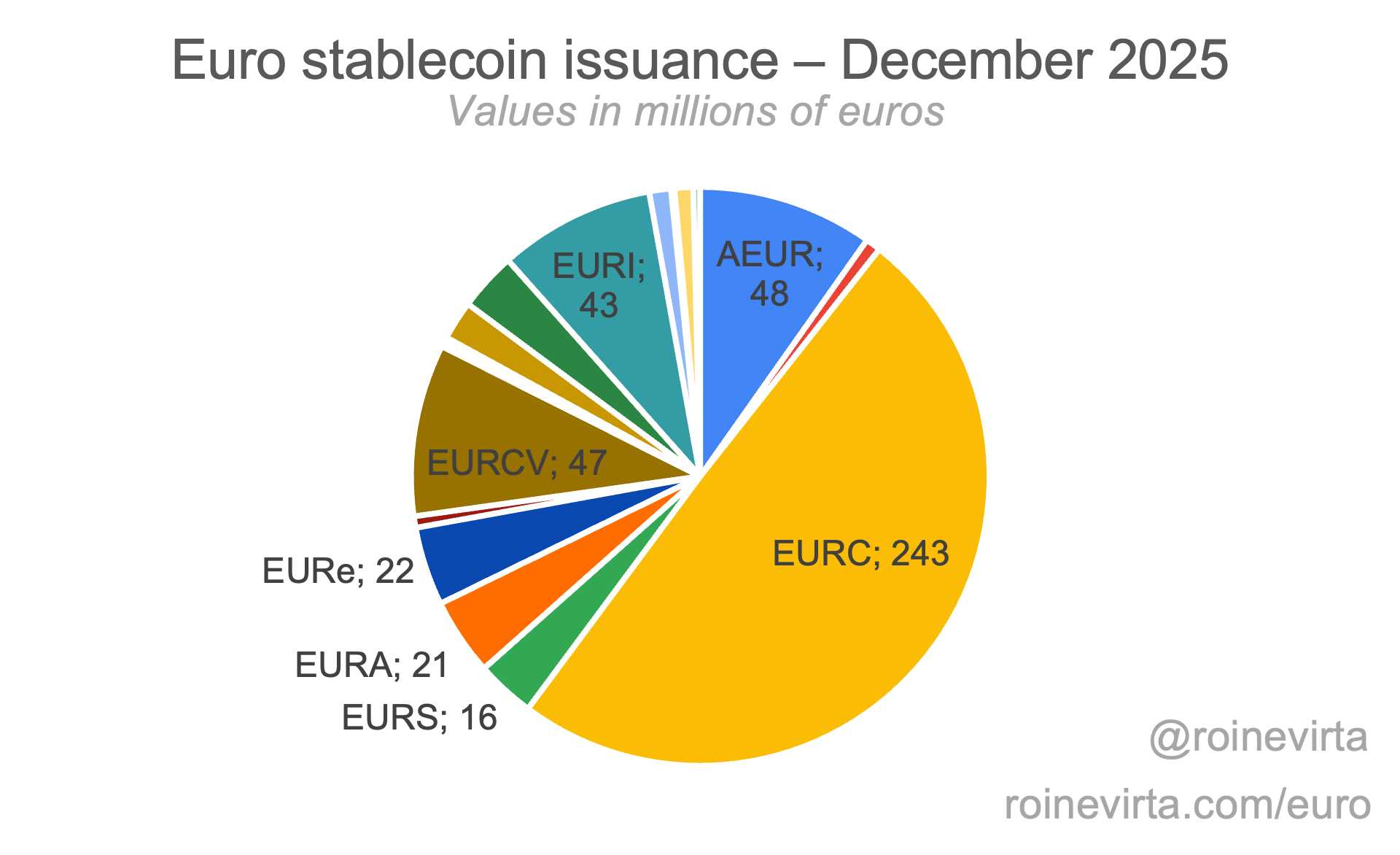

Composition data is based on total issuanceIssuer Consolidation Continues

The composition of euro stablecoins has changed heavily over the past year. EURC dominance has increased significantly, driven by its 200%+ YoY growth. That’s the most growth of any euro stablecoin in absolute terms, and in relative terms only third to EURQ’s which went from 1.5m to 16m in supply (almost 1000%) and EurR’s ~240%.

While EURC dominance growth has NOT negatively impacted other issuers, it’s market dominance by issuance has changed the market dynamics slightly. Circle has been pumping the numbers in both holders and issuance to grow into a “dominant” position by the most used comparison metrics. By my count, at least approximately 25% of holders and 30% of issuance are fake, as discussed last year. The number may be much higher but it does not matter because, on the surface, Circle leads. Unless unseated, this will likely establish EURC as the de facto market leader, and therefore the canonical euro stablecoin. An important strategic win.

This year there was slightly less movement amongst the stablecoin rankings. EURC dominance continued growing while – as I predicted last year – the non-regulated euro-stablecoins continued to decrease in importance with EURt supply decreasing by 84% and VEUR by ~50%. The top 5 largest stablecoins (rank change) at year end are:

- EURC at 294m€ (±0)

- EURCV at 55m€ (+1)

- AEUR at 48m€ (-1)

- EURI at 43m€ (±0)

- EURe at 22m€ (+1)

Fiat-Backed Stablecoin Dominance Grows

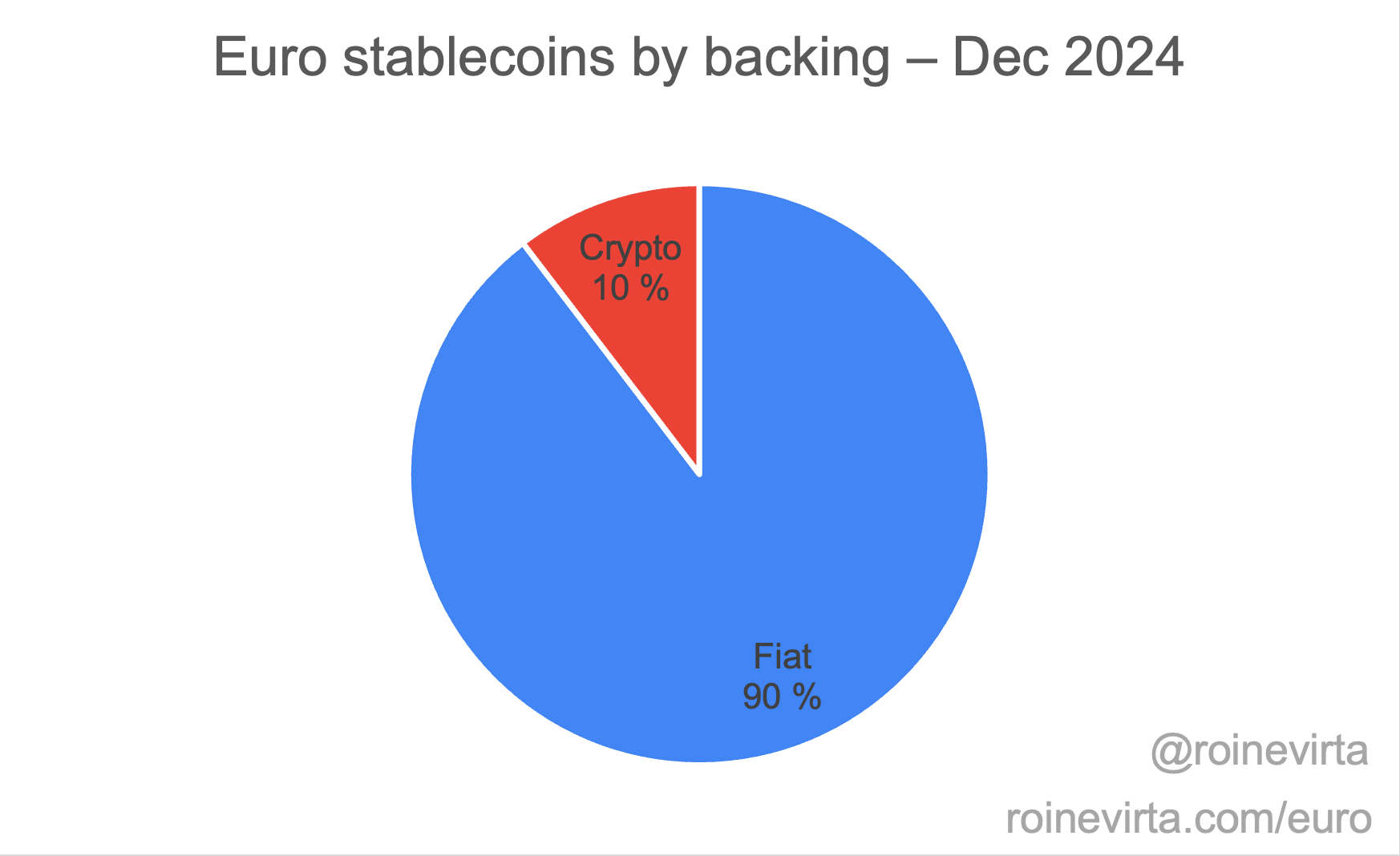

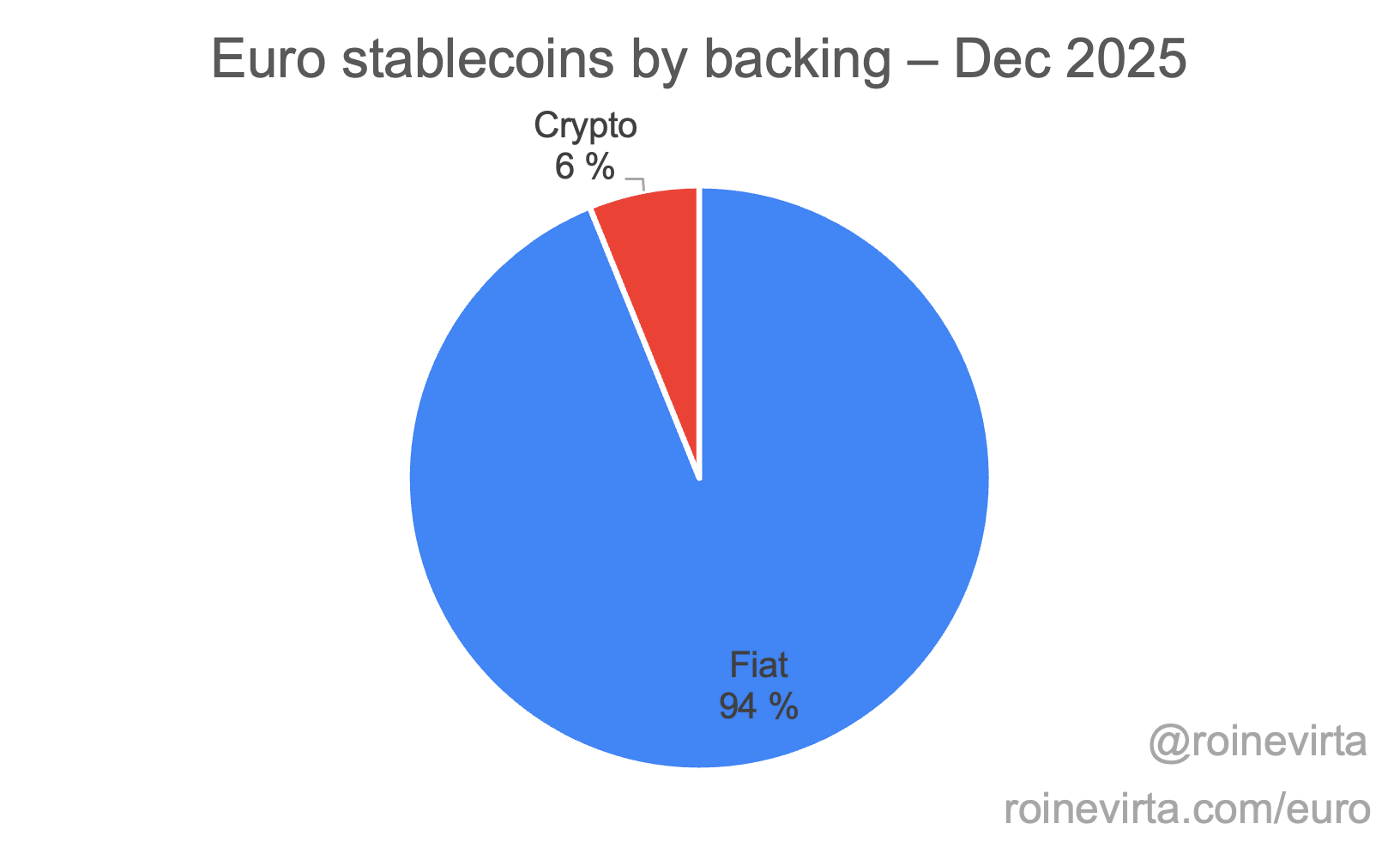

As per the goals of MiCA to bring euro stablecoin issuers into the purview of EU regulators, crypto-backed (CDP) stablecoins have continued to lose market share to their fiat-backed counterparts. Down from 21% two years ago to 10% last year and to a meager 6% now.

While market shares have been decreasing, new issuers have popped up. Especially notable, given Usual Money’s past successess with USD, is their choice to launch EUR0 into this secularly declining market. There are now a total of 11 non-fiat backed stablecoin issuers (EURO3, EURA, eEUR, IBEUR, jEUR, EURm (fka CEUR), PAR, SEUR, EUROs, EUR0, dEURO). None has seen any notable growth and their aggregate market capitalisation remains dominated by EURA. These stablecoins will likely continue to be pushed out due to being hard to access unless one of them manages to offer sustainably attractive yields to holders. Even then, however, whether users would rather use a larger fiat-backed stablecoin in a high-Lindy lending protocol over a yield-bearing stable remains uncertain.

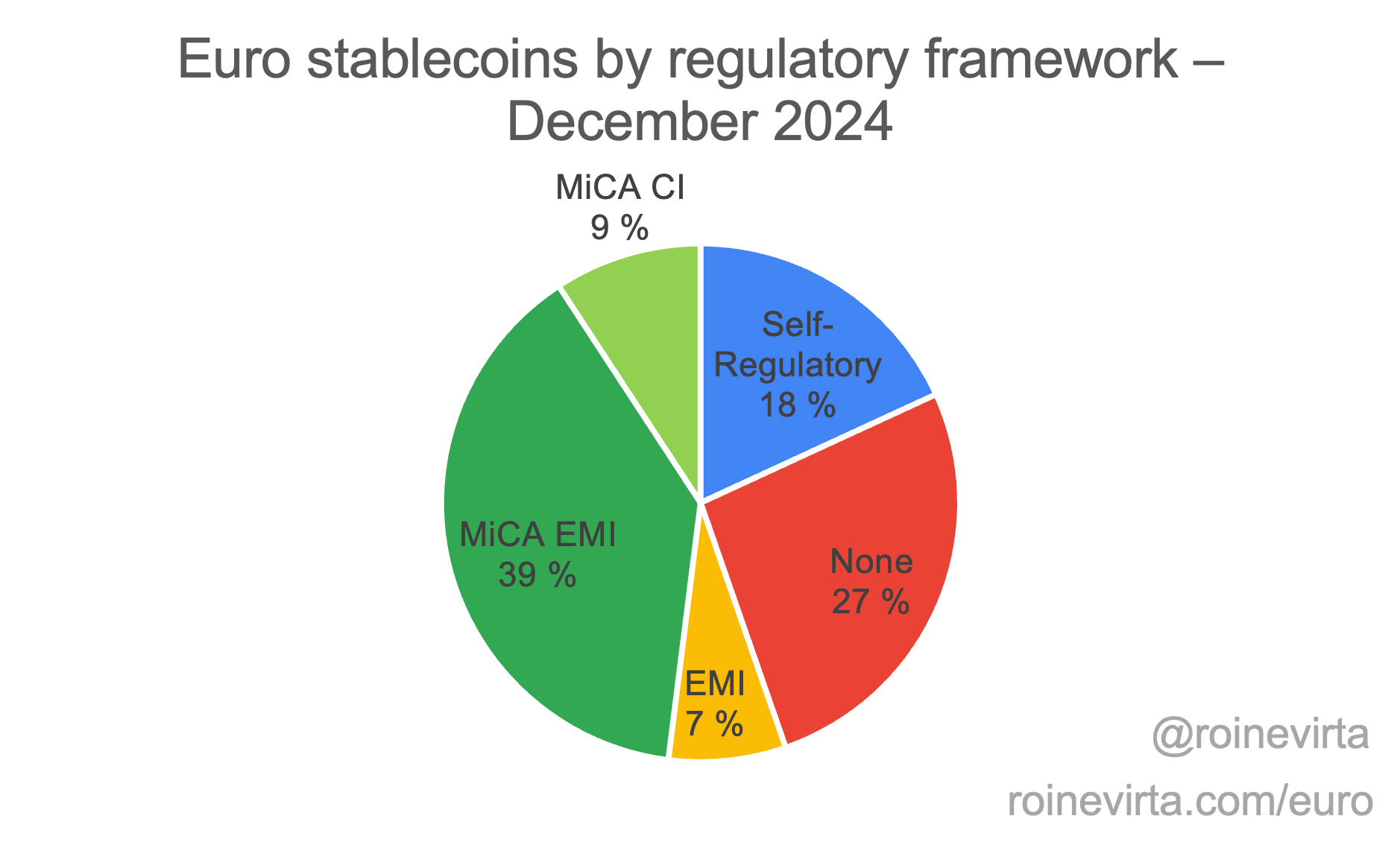

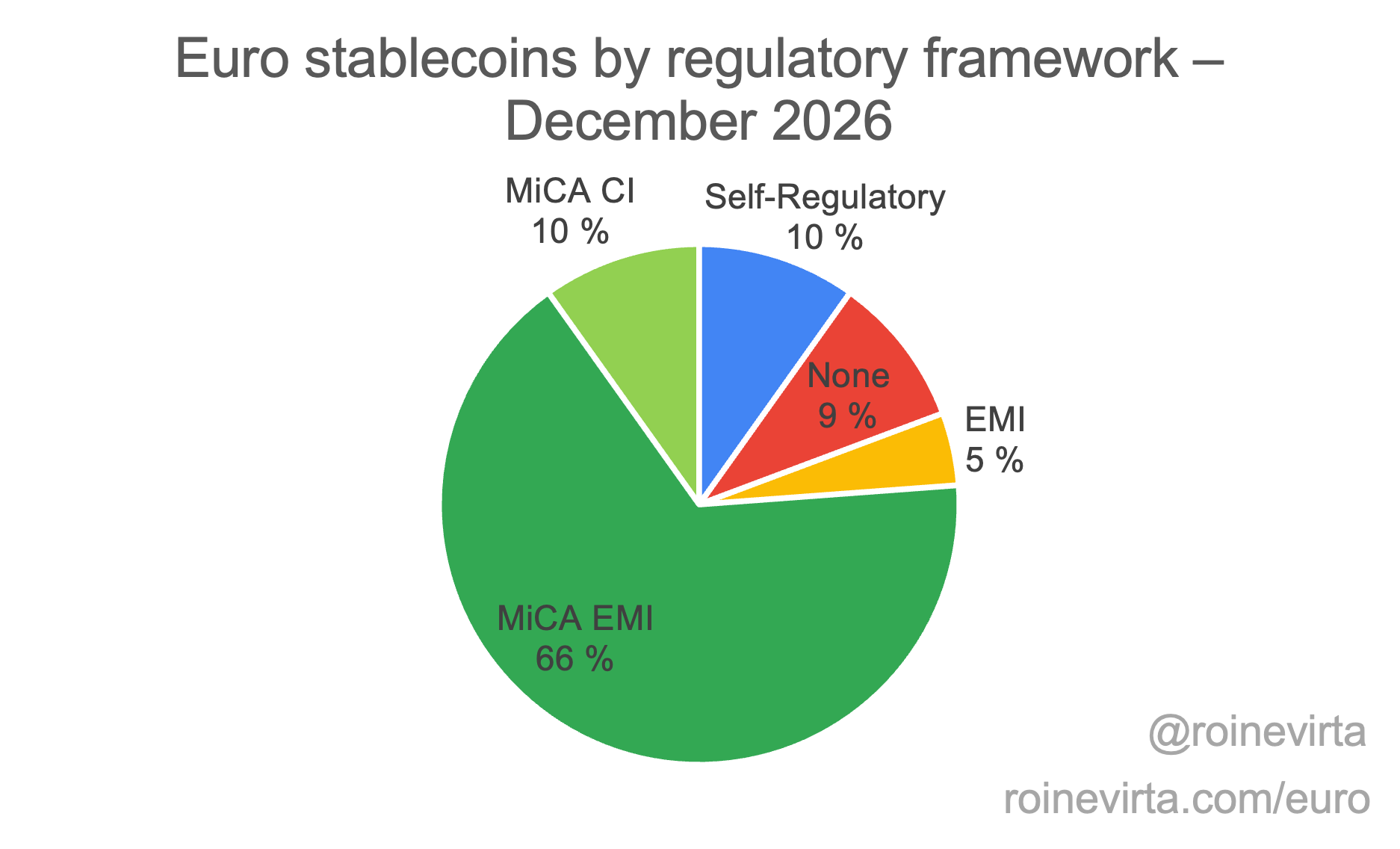

More Stablecoins Are Being Brought Into the Regulatory Perimeter

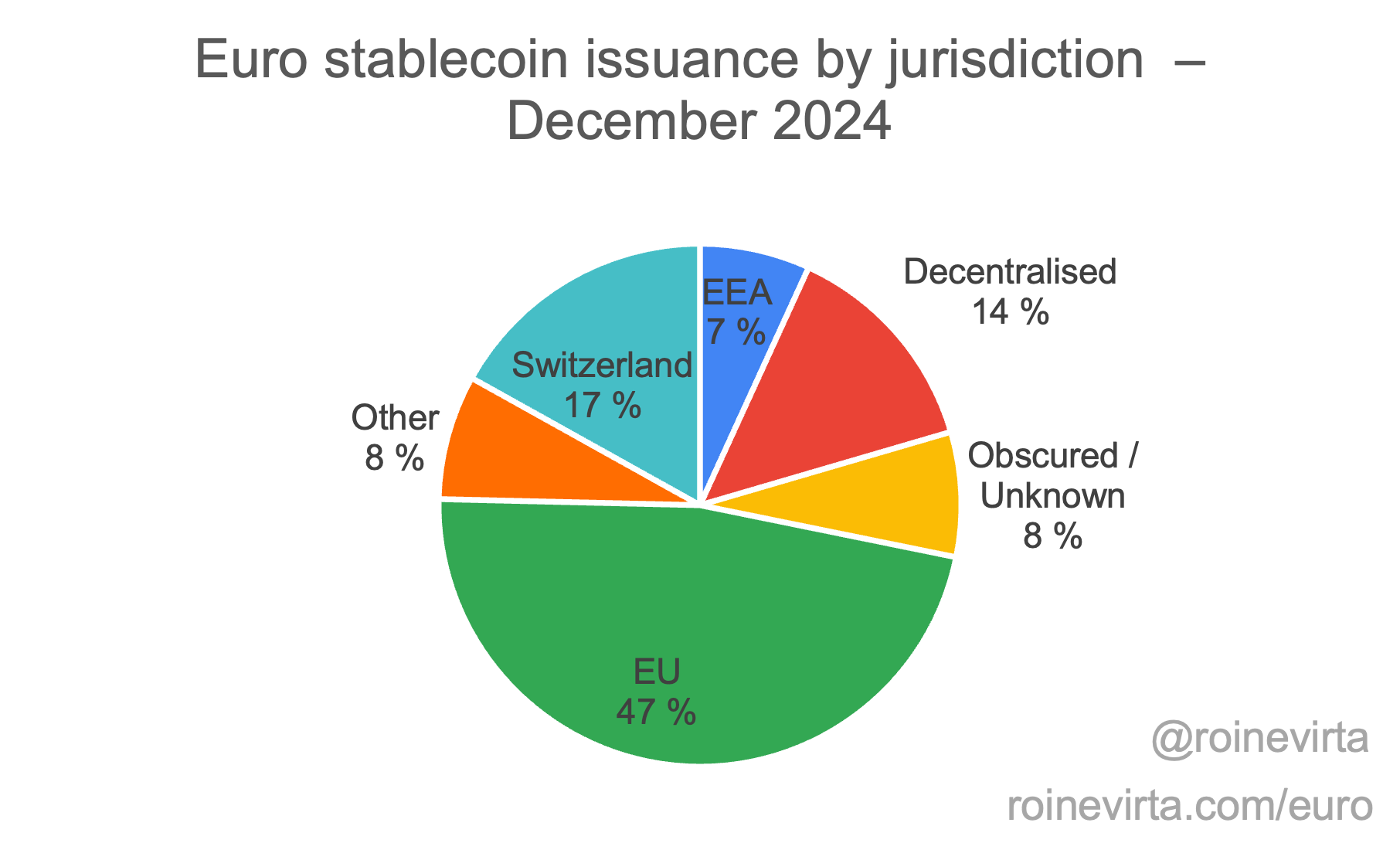

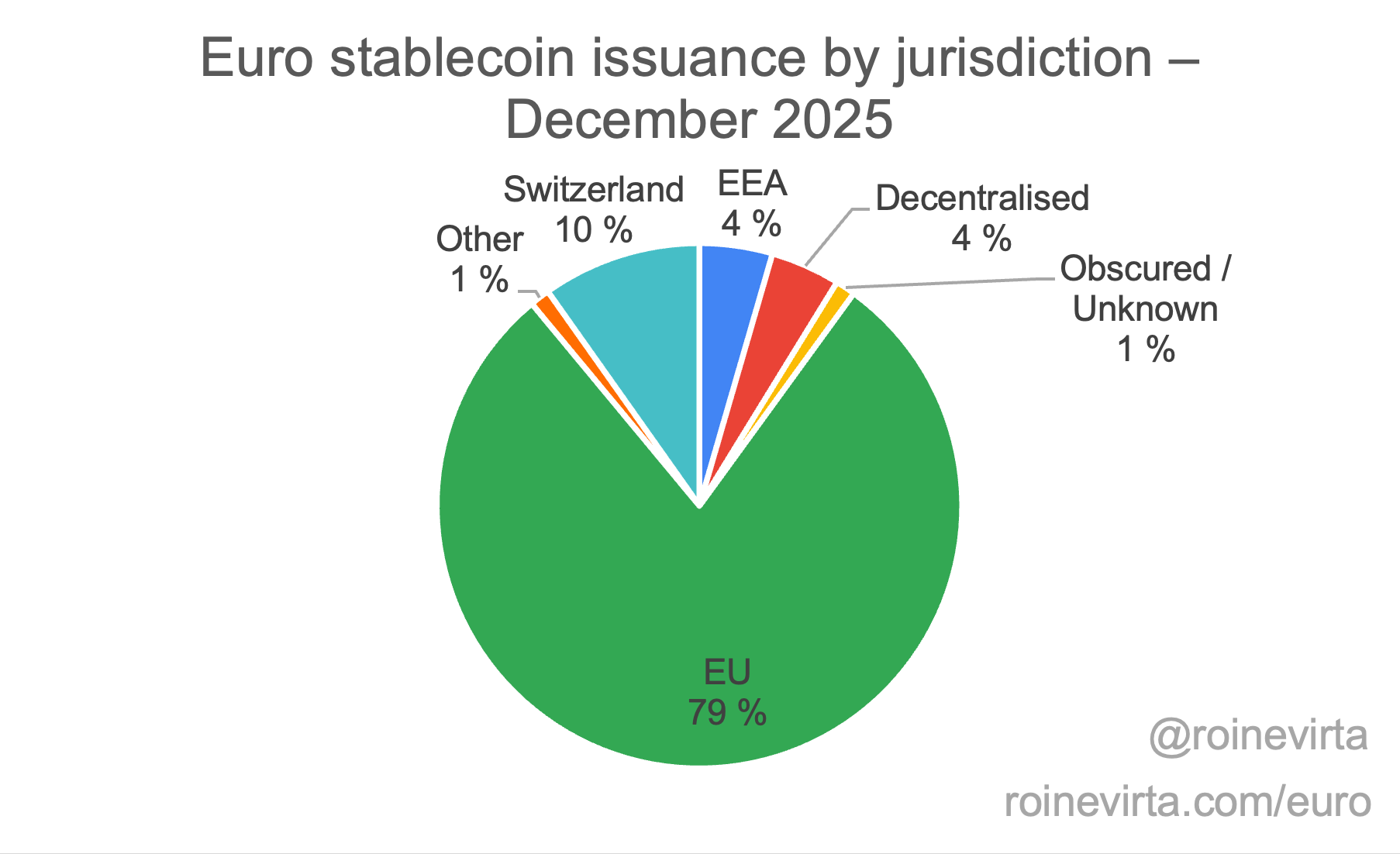

Similar to 2024, stablecoins continue moving into the regulatory perimeter. Stablecoins issued under MiCA have seen the largest growth while self-regulatory and non-regulated have been increasingly pushed out.

This trend follows earlier patterns and I expect it to continue in 2026. All of the announced but pre-production stablecoins fall under the regulated category and there’s little interest in the trenches in starting yet another decentralised euro stable. Especially with the Angle team focusing more on Merkle and the decline in EURm (fka CEUR) supply, the leading non-regulated candidates are not in a strong position going into 2026.

More Issuers are Based in the EU

As expected, issuers’ registered addresses have also been moving into the EU, unsurprisingly as MiCA issuers need an office in the EU.

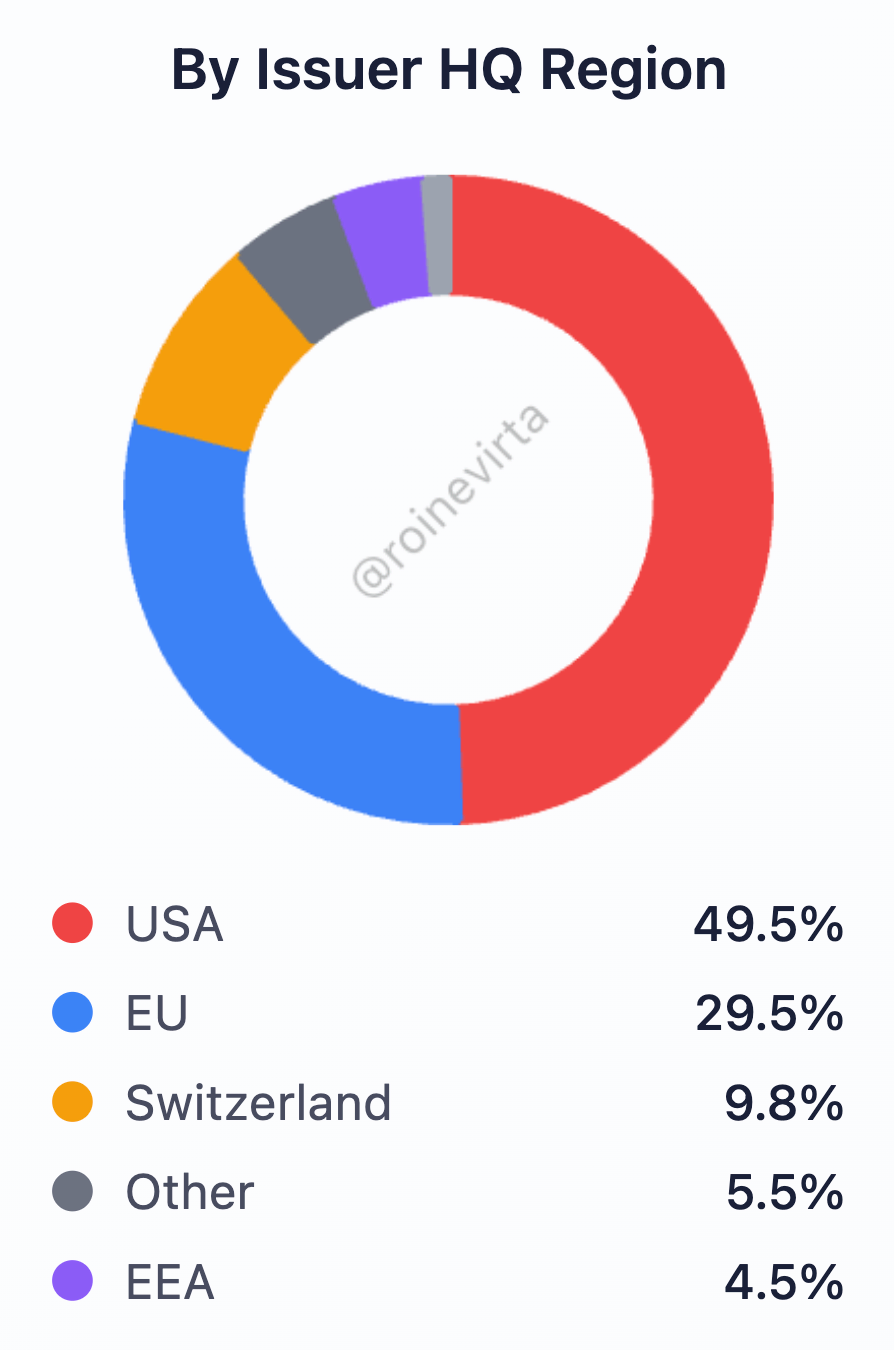

However, while issuers have offices in the EU, they may be effectively governed outside of the EU. Two of the current EU-registered issuers, Circle and Paxos, have offices in France and Finland, respectively, but are de facto headquartered and managed from the US.

This tension is highlighted in a new graph available in the euro stablecoin dashboard; Supply breakdown by issuer HQ location.

This is an important metric to pay attention to from European financial sovereignty perspective. If the trend continues and US-issued Euros continue dominating, Europe’s monetary system will be – as today – controlled by US firms.

This is an issue everyone can help with their day-to-day choices. Euro stablecoin users can choose European alternatives, talent can choose to work in EU firms, allocators can choose to fund European firms. It’s a common effort.

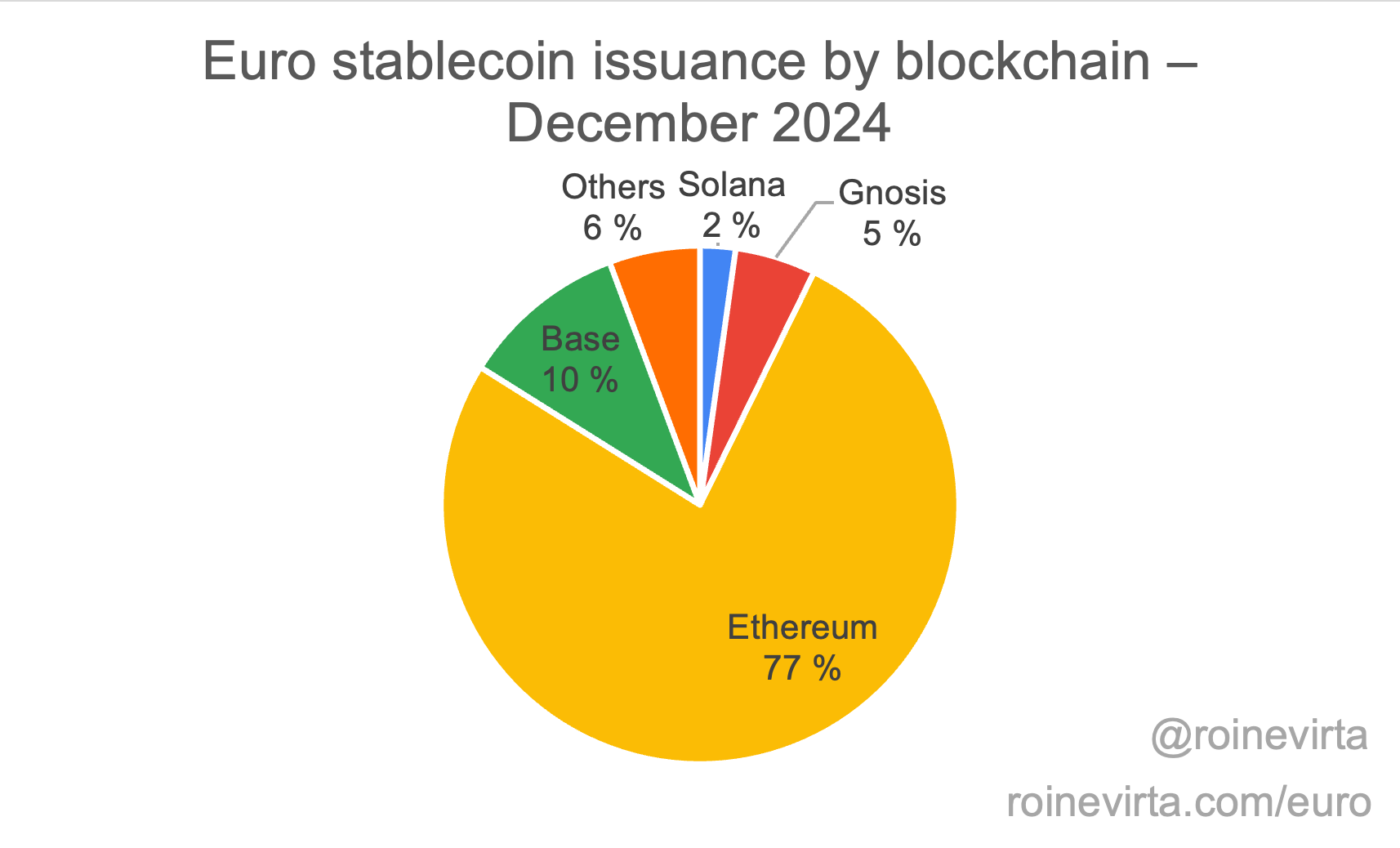

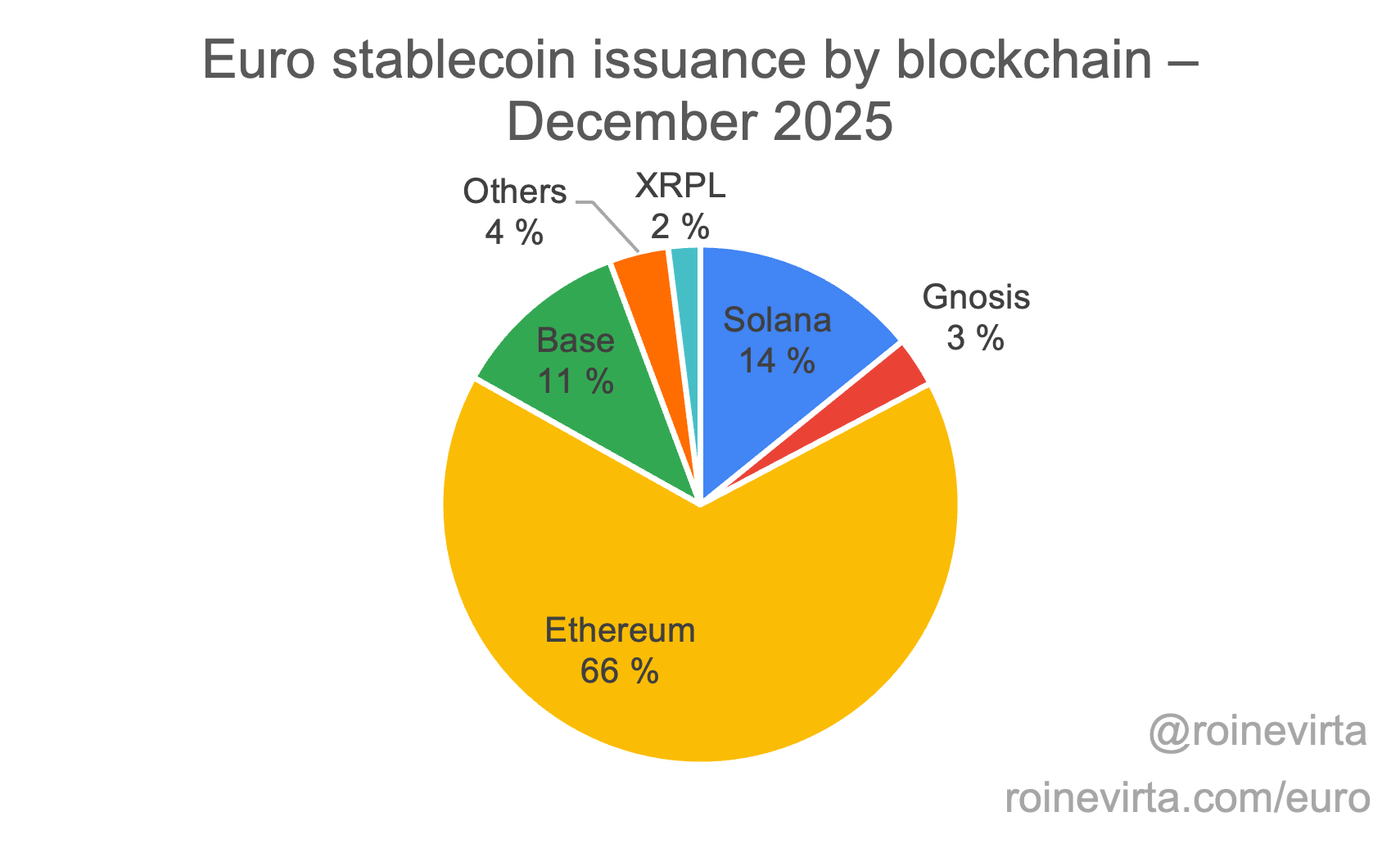

EVM Continues to Dominate but Solana Share Grows

Euros exist, mostly, on the same chains as they did last year. Solana has captured a slightly larger share of issuance and as an unlikely expansion destination Concordium – a European payments focused L1 – received Stablr’s EurR & VNX’s VEUR support.

Gnosis’ euro share has shrunk slightly, led by the non-growth of Monerium’s EURe, which is arguably too aligned with Gnosis to its own detriment.

More Issuers than Last Year but Potential Winners are Easier to Spot

Some issuers have been very heavy on announcements but not so good in producing any tangible results. An excellent example is AllUnity and its EURAU. Paraded for literally years before first deployment in July, it has just 82 holders across 5 chains and apparently almost 30 people managing less than €1m in supply.

As AI Fund’s Andrew NG puts it:

A strong predictor of a startup’s odds of success is its execution speed.

This section focuses on the most prominent/interesting euro stablecoin issuers. You can find a full list of euro-stablecoin issuers in the appendix at the end of the page.

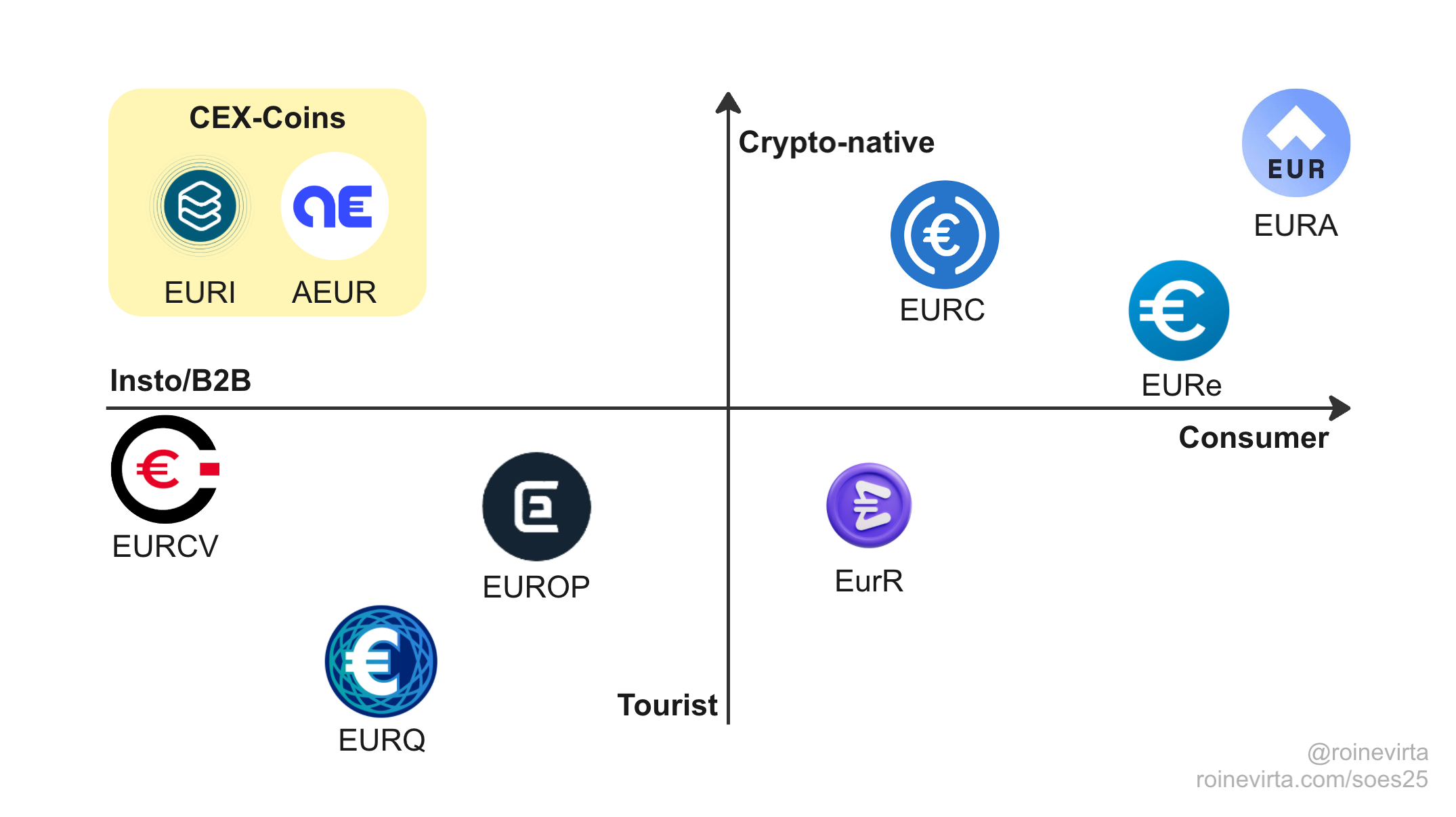

There is Clearer Strategy Differentiation Amongst Issuers

It is clearer which issuers are pulling ahead of others than it was last year. I’ve updated the market map to reflect this change.

Last year’s market map was on the Compliant/Renegade – Decentralised/Banking Integrated -axis. This year, seeing the industry consolidation and focus on fiat-backed stablecoins, I’ve changed to Crypto-Native/Tourist – Insto/Consumer -axis. Please note that the positions in the chart are relative – not absolute.

Each of the issuers seem to be taking a slightly different approach in their attempt to enter and dominate the euro stablecoin market. While everyone seems to agree on the high-level thought that money is not so much in issuance but in the add-on/value-add services, there is a clearly identifiable difference in how every meaningful issuer aims to achieve this.

Firstly, Banking Circle’s Eurite (EURI) and Anchored Coins’ AEUR have to be isolated from the rest of the market. They serve a single client: Binance. More or less 80% and 100%, respectively, of each coin is held at Binance. AEUR was the original Binance choice, but being issued from Switzerland, they can no longer serve an European clientele, which has led to a third of the supply melting away over the past two years. Banking Circle, as one of primary Binance banking partners in the EU, stepped in with EURI in July 2024. These two issuers can be, in my mind, safely discounted from any “real” competition as Binance’s economic arrangements make the coins non-viable from the start.

The only non-fiat-backed stable is Angle’s EURA. They are the largest such Euro stable and have – by far – the most holders at over 1.1m across all supported chains. The Angle team is extremely crypto-native. They’ve built with a focus on liquidity, DeFi-usability, and passing yield back onto users. Angle’s recent successes with Merkl, an incentive-coordination platform, has, however, reduced the focus on EURA and it will likely remain a niche product for the foreseeable future. Their strategic focus had historically been DeFi-first.

Monerium, the second-most consumer-oriented euro-stablecoin, thanks to their close collaboration with Gnosis Pay (payments card), has not seen any larger developments over the year. Their momentum seems to have stalled, their dependence on Gnosis increased (+6pp to ~77% Gnosis dominance), and growth stopped (±0 YoY). For more, I refer to last year’s commentary. Monerium’s strategic focus has been on enabling consumer-initiated on/off-ramping and growth via grassroot usage.

As for Quantoz – they’ve grown over 10x – on paper. EURQ is issued on five blockchains; XRPL, Xahau (though Henri should check the assigned DTI!), Algorand, Polygon, and Ethereum with most of the supply on the latter. The first three blockchains are mostly idle with just a few holders on each. Even the Polygon variant has just 15 holders and, therefore, most of the activity being on Ethereum. Most of the issuance on Ethereum is held by issuer-associated addresses, and netting for this leaves EURQ at around €5m supply with very low activity. However, even if onchain activity is low, CoinGecko data indicates decent trade volumes at around €15m/day, albeit on well-known non-EU wash trading exchanges. The real story of Quantoz and EURQ continues to evade me. Quantoz has been around as a payments company for a time longer than their EMTs and their GTM strategy most likely reflects that.

Stablr’s EurR, which, even though incorporated in Malta, actually comes from the emerging European stablecoin capital of Amsterdam, has grown to a commendable size of €10m+ in just a year. Stablr is truly going exchange-first, with over 98% of its supply on CEXes. Most of Stablr’s trading volume also comes from wash trading exchanges though it also – not unlike EURQ – has a Kraken listing. Stablr is pursuing a CEX-first GTM strategy, apparently trying to saturate the potential ecosystem entry/exit-points.

SG-FORGE surprised with a Morpho integration this year, showing some appetite for DeFi. Their EURCV stable is issued on Stellar (no usage), XRPL (no usage), Solana (no usage), and on Ethereum where it has ~450 holders. Forge has done a good job seeding both DEX and lending markets. Uniswap v3 has almost €5m in EURCV/USDC liquidity. However, the tick ranges have been set pretty loosely and a swap of ~€100k yields over 20bp price impact. The Morpho EURCV Prime vault, managed by MEV Capital, currently yields around 6% APY which is slightly higher than Yo’s 5.5% blended rate and much higher than the ECB’s Deposit Facility rate at 2%. Beyond Uni & Morpho, EURCV is also available in Angle’s Transmuter, allowing for large (~€500k+) EURA purchases with zero price impact trades. There’s also a small EURCV/WETH volatile pair in PancakeSwap. SG-FORGE is following a demand-induced GTM strategy, most likely responding to internally (within the group) sourced demand for use cases.

Like this article so far? Help others discover it by sharing it in your network.

Circle’s EURC added €164m in issuance over the year, with many addresses only accumulating EURC but not using it for anything. It is currently issued on Stellar, Avalanche, Solana, Ethereum, Base, and World Chain. EURC is by far the most liquid fiat-backed euro stablecoin. On Aave, EURC is part of the Base Market and Core Market, allowing borrowing/lending against assets such as USDC, cbWBTC, & ETH. Additionally, EURC has lending markets on Morpho, Kamino, Jupiter Lend, and Drift, among others – making EURC the most integrated EUR stablecoin across DeFi. Circle is following a piggyback strategy, slowly injecting EURC where USDC had already been made available.

Schuman’s EUROP is by far the most used euro stablecoin on XRPL (with ~200 holders). Polygon, Ethereum, and Avalanche are – interestingly – less popular by holder count. Most of the issuance still sits on Ethereum. Schuman is following an API payments product first strategy.

More Issuers are Focusing on Programatic Add-On Services

Issuers, as a whole, have seemed to understand the risk, lack of profitability, and impediments for growth in solely focusing on stablecoin issuance. Building add-on products to serve customer use cases adds complexity and cost but it is becoming an increasing necessity in the search for adoption. Creating stablecoins has been commoditised and supporting new supply sinks requires making the adoption journey as smooth as possible. An underappreciated aspect is that stablecoin issuers are onboarding the next crypto users.

Add-on services in the context for stablecoin issuers usually centre around the core business; money movement. Be it payment facilitation or even FX, issuers are primarily in a payments business. User funds need to get onchain, and often also off the chain. The remit of API-first products is usually rather constrained as custody and other supporting services have also been commoditised.

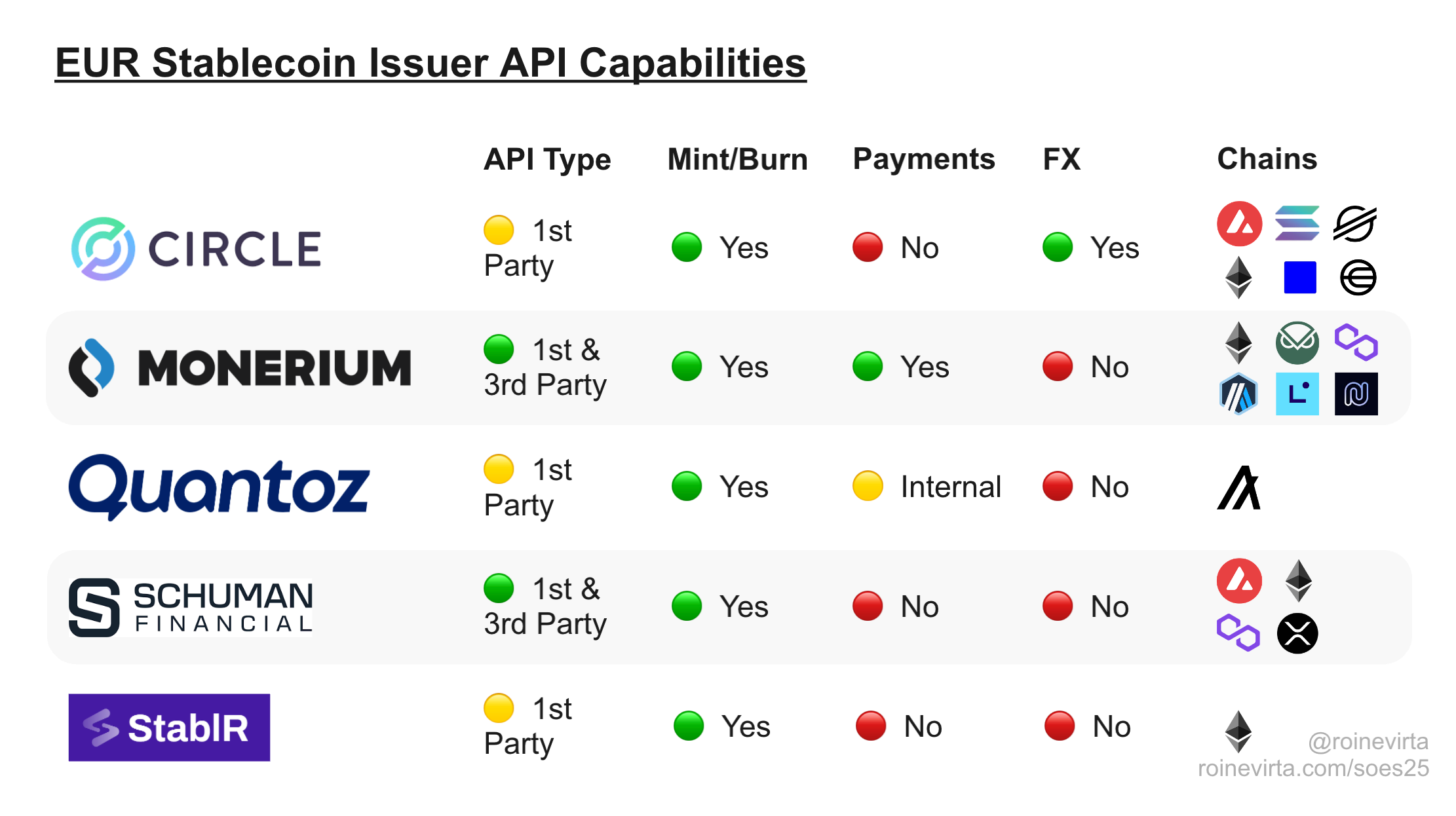

So what are the kind of add-on products served via APIs like?

- Circle makes the Circle Mint and StableFX products available for EUR as well. This comprises on/offchain fund transfers, business accounts, and EURC/USDC trading.

- Monerium’s API allows KYC’ing end-users, user-specifc vIBAN generation, and on/offchain fund transfers.

- Quantoz allows for on/off-ramping and making payments between Quantoz accounts.

- Schuman’s API allows user-specific vIBAN generation and mint/redeem addresses management (which pass funds through as an on/off-ramp).

- StablR: allows on/off-ramping.

The APIs have a lot in common. The most notable difference is that Monerium and Schuman allow serving customers of customers, versus others servicing only first-party transactions. This differentiates Monerium and Schuman as financial infrastructure that can enable other businesses whereas Circle, Quantoz, and StablR are doing the bare minimum to be usable by high volume clients. If you are looking for a winner from a product feature perspective, it’s Monerium or Schuman. I’ve privately heard more good about the APIs of Schuman than Monerium.

The other “obvious” direction for issuers to take on is FX. While only Circle allows for API-based FX, many issue both a EUR and USD stablecoin, such as StablR’s EURR/USDR and Quantoz’s EURQ/USDQ. Some issuers might be looking into providing some of this FX capacity in-house, but whether it makes commercial sense is yet to be determined as this does stray quite a bit from the core capabilities, with dedicated specialist FX desks being able to provide better spreads.

Payments Volume and DeFi Usage Have Increased

Payments using euro stablecoins have grown even more than their issuance. For example, EURe – the most organically used euro stablecoin – has grown its Gnosis Pay weekly volumes from ~€1m at the end of last year to ~€2m this year – without adding new supply!

While I do not have the most robust data handy for payments volume, I estimate a 2-8x increase in total Euro stablecoin payments volume, compared to the 50% increase in supply, indicating an increased velocity of money. The Gnosis Pay data is particularly interesting as it puts the money velocity for EURe at approximately 10 where St. Louis Fed observes Q3 money velocity at 1.65, indicating internet-native money moves at least six times faster!

Issuers and ecosystem participants should be paying close attention to the increasing money velocity. Its ramifications are well-beyond obvious. As my friend Gregoire le Jeune once put it,

if money moves like data, treat it as such

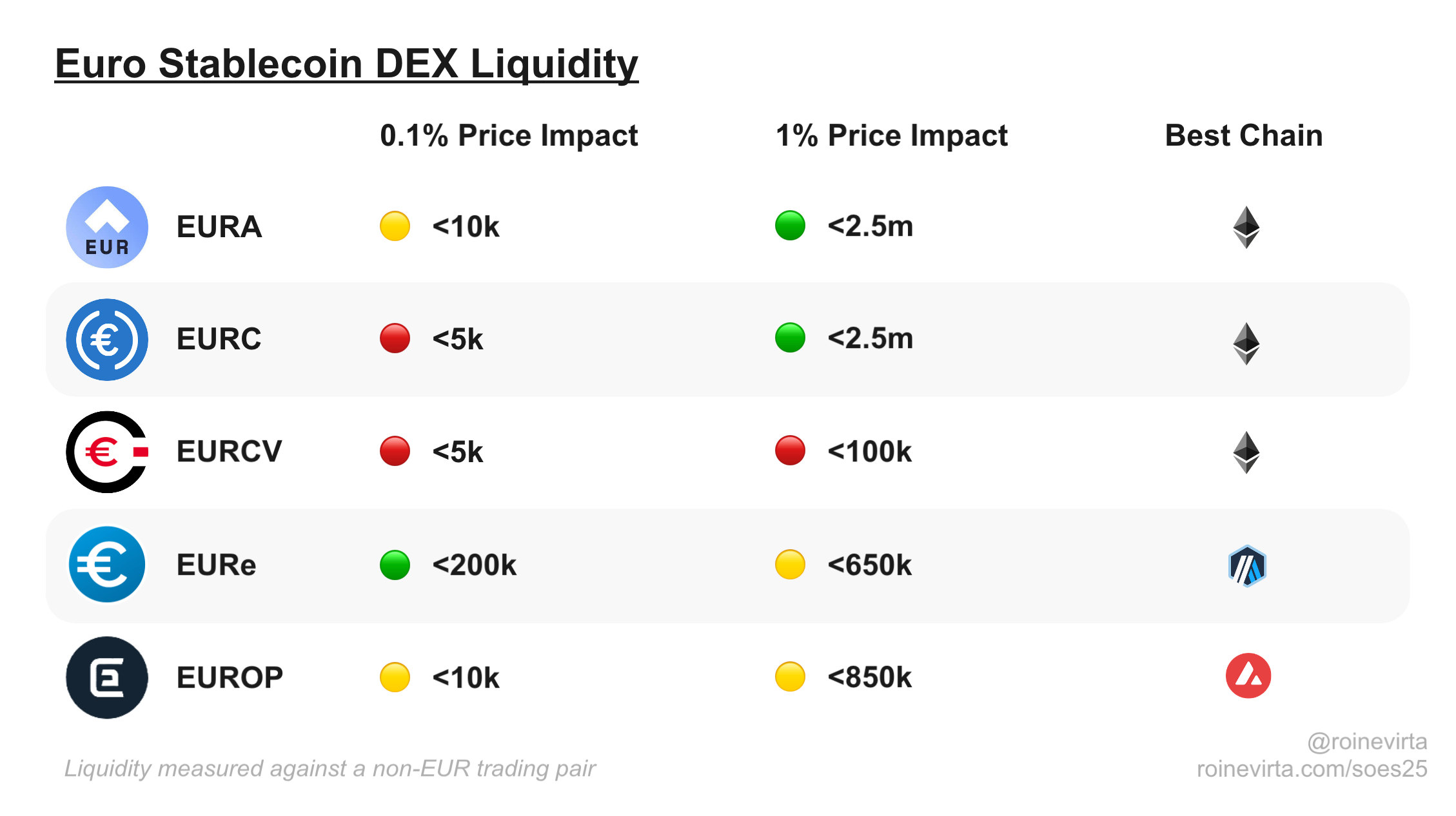

Among increased volumes, DeFi integrations have also improved, primarily led by broader EURC adoption and EURCV’s, EURe’s, & EUROP’s strategic injections into DeFi.

The most notable venues with Euro stablecoin support today are Aave across Ethereum, Base & Gnosis instances, Yo with its EUR product, Morpho vaults for EURC and EURCV, EURe lending on Spark on Gnosis, and EURC support in Kamino, Jupiter Lend, & Drift. Rest is primarily deployed in liquidity across various DEXes, with Uniswap leading as the primary liquidity destination by a large margin. View my Euro DeFi dashboard here for more.

Even though some issuers have committed significant capital into DEX liquidity, its not equally managed. The best example is the very large but loose liquidity of EURCV. They could achieve much better outcomes with the same capital by managing their positions better.

While interest in lending products and vaults has increased, DeFi vault TVL is still well below where it “should” be. As per data from TradingStrategy, currently only 1-2bp of all DeFi vault TVL is in euros. Using USD vaults as a benchmark, euro vaults should have 3-5x more TVL.

Overcollateralised EUR stablecoin supply APYs fluctuate mostly between 1% and 5% before incentives, and between 3% and 7% with incentives when pushing up the risk curve. Below are some examples of the current yields available for Euro stablecoins – not endorsements!

| Type↕ | Chain↕ | Venue | Stablecoin/Pair↕ | 30d APY↓ | Notes |

|---|---|---|---|---|---|

| Volatile LP | Base | Hydrex | EURC/WETH | 58% | Merkl incentives |

| Volatile LP | Base | Hydrex | EURC/cbBTC | 53% | Merkl incentives |

| Vault | Base | Singularity | EURC | 45% | — |

| Volatile LP | Ethereum | Uniswap V3 | EURCV/USDC | 16% | — |

| Volatile LP | Ethereum | Uniswap V3 | EURC/ETH | 13% | — |

| Volatile LP | Arbitrum | Aura | EURe/aUSDC | 11% | — |

| Vault | Ethereum | Morpho: Steakhouse EURA | EURA | 10% | — |

| Other | Ethereum | dEURO Savings | dEURO | 10% | — |

| Stable LP | Ethereum | Stake DAO | EURA-EURt-EURS | 9% | — |

| Volatile LP | Ethereum | PancakeSwap | EURCV/WETH | 8% | — |

| Volatile LP | Solana | Orca | EURC/SOL | 8% | — |

| Vault | Ethereum | Morpho: MEV Capital EURCV Prime | EURCV | 7% | Includes incentives |

| Vault | Base | Tokemak | EURC | 6% | Includes incentives |

| Vault | Base | Yo | EURC | 6% | — |

| Lending | Gnosis | Spark | EURe | 4% | — |

| Lending | Gnosis | Aave | EURe | 3% | — |

| Vault | Ethereum | Kiln Metavault: Bitpanda MEV Capital EURCV Prime | EURCV | 3% | — |

Table 1: Examples of current yields on EUR stablecoins. Not endorsements. DYOR.

As can be seen, any yields are currently primary concentrated around EURC, EURCV, EURA, and EURe. Other euro stablecoin DeFi ecosystems are much less developed. EURC seems to be the current DeFi leader in terms of numbers of integrations and use cases. However, it would be still “easy” to displace with a concentrated effort and sufficient budget.

While there aren’t any true money-lego markets yet, some industry practioners have indicated client interest in, e.g., utilising Aave EUR receipt tokens as collateral for shorting USD. As the first layer of DeFi markets continue saturating and become more liquid, it is possible that we see the first stacked/lego-products coming onchain in 2026.

Issuers Are Starting to Look For Opportunities Beyond Simple Issuance

While the euro stablecoin market grew, organic growth still poses a challenge to the issuers. There are no easy growth loopholes from, e.g., tokenised carry trade strategies like what is being done by Brix with the Turkish Lira. Therefore, as outlined previously, issuers are now looking to grow through product features. As these start going online during 2026, any issuers with good products, marketing, and sales might find greater-than-market growth, assuming the products have real use cases.

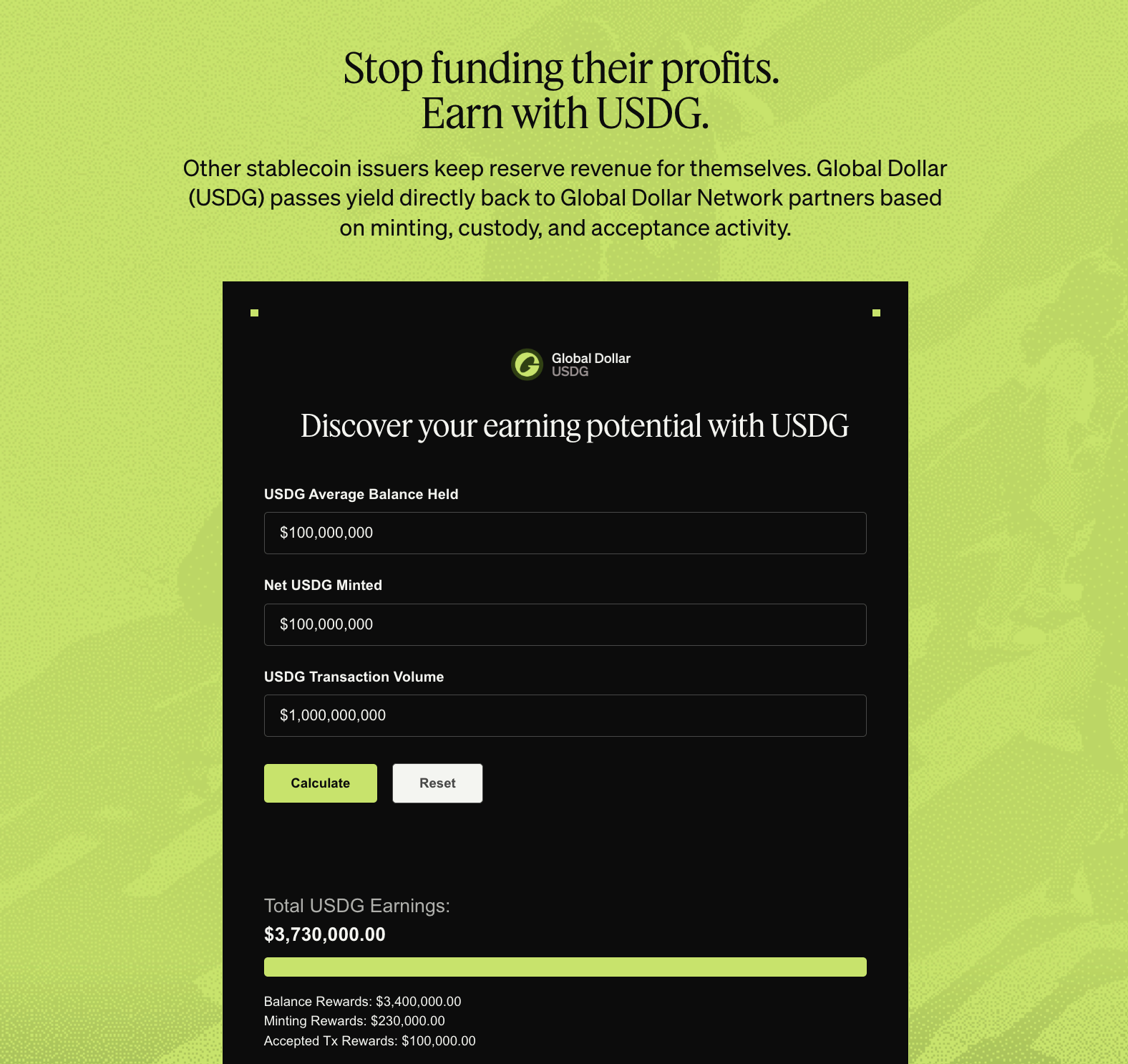

I’m personally very bullish on 3rd party money movement APIs, allowing both crypto-native and non-native businesses to streamline both EUR and non-EUR movement. Whether issuers are sufficiently capitalised and agile enough to deliver these next-gen money movement experiences is something to pay close attention to in 2026.

While products – like PSP activities – that deviate from issuance may be important, even critical, to go-to-market execution, issuers should remain very cautious of doing so. It’s true that small issuers (currently probably all of the issuers) lose money. However, large scale issuance is still a very attractive business to be in, as Tether continues to show year after year. You can use the below calculator to play around with the profitability of issuing a MiCA-compliant euro stablecoin.

Stablecoin Issuer Profitability Calculator

Operating Environment

| Yield on Bank Reserves | % |

| Yield on Non-Bank HQLAs | % |

| NIM Revenue Share | % |

Capital Structure (€m)

| Total Issuance | €m |

| Bank Reserves30% | €98.40 |

| Non-Bank Reserves70% | €229.60 |

Income & Costs (€m)

| Bank Reserve Income | €0.00 |

| Non-Bank Income | €5.85 |

| Net Income | €-0.00 |

Economic Viability (€m)

| Est. Market Cap | N/A |

Looking at the current issuers, we can see inadequacies in funding to drive large-scale, concentrated growth campaigns. The best funded issuer, apart from Circle, is Schuman who raised €7m in 2024. While their team (15+ people) is rather large relative to issuance, they might have enough of capital to actually push DeFi adoption through incentives while also setting up a repeatable sales process for their API-based product.

If one of the existing, or any of the new issuers, finds good PMF with their initial add-on products, we will also likely see issuers increasingly move into the PSP business to find new revenue sources and increase their distribution surface area. Similarly, I would not be surpised to see a crypto-friendly neo-bank, like Januar, dabbling in issuance. However, I maintain it would be better – both for the bottom-line and user experience – for non-issuers to stay away from the issuance business and instead partner with an existing issuer. Euro-stablecoin issuers are not sufficiently pursuing growth-by-partnering strategies, as their higher growth USD counterparts like Agora’s AUSD and Paxos’ USDG have done.

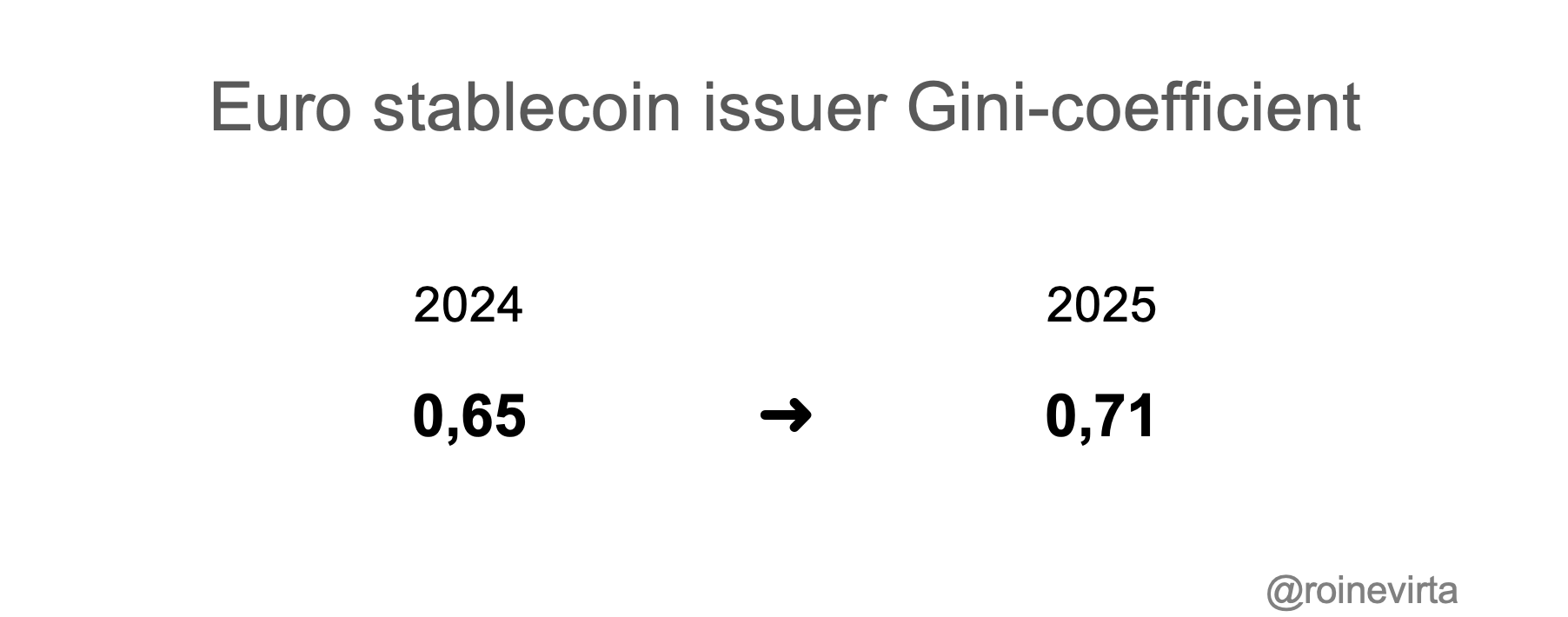

2026 Will See Further Consolidation with First Banks Starting to Chip at the Prize

Let’s be clear. I do not believe any bank-led stablecoin will truly “break through” in 2026, with the potential exception of EURCV, depending on the extent to which they continue pursuing their DeFi GTM. However, industry consolidation will likely continue and the issuer Gini-coefficient will become even higher. I believe that stablecoins are currently an oligopolistic business and next year’s consolidation will make clearer who the medium-term winners are in the euro-stable land. Current trends and fundamentals would likely suggest towards EURC, EURCV, and EUROP.

What will happen, however, is that the upcoming and announced FI-led stablecoins (most importantly Qivalis and to lesser extent Bancomat’s stable) will start rattling the pants of the current issuers. While these issuers are unlikely to gain any significant market share during 2026 or perhaps even 2027, they have the potential of changing market structure. But only if the banks associated with the businesses are willing to take the leap of faith and start integrating stablecoins at the existing distribution points (mobile banking apps).

In the medium/long-term, Qivalis might be Europe’s best chance at financial sovereignty. For them to win over Circle and build a lasting euro stablecoin monopoly, a few things must happen (note that these ideas are not unique to Qivalis):

- Partner banks MUST integrate fast and free stablecoin minting & redemption within their mobile banking apps. Distribution is key to building acceptance and integration. This should form the core of the GTM strategy.

- Qivalis MUST allocate sufficient capital and freedom of action to the person leading DeFi efforts. DeFi is the only part of the blockchain-enabled stack that enjoys high network effects. Getting the core integrations is important as the rest falls in place almost naturally. Winning DeFi is crucial as it drives utilisation decisions even beyond DeFi. Non-DeFi acceptance is a less networked, more linear business development issue.

- Qivalis MUST have complete strategic and operational independence from the partner banks. Building a stablecoin business properly involves cannibalising partner banks’ core businesses and therefore complete independence is necessary.

- Qivalis MUST build a competitive third-party API-first vIBAN & payments capability so as to become a vital part of future’s core underlying financial infrastructure. It’s easy for any participant in the blockchain enabled financial ecosystem to swap one stablecoin for another, but a deeply integrated fullstack payments capability is not.

- Qivalis MUST start building an incentivised partner network, similar to Paxos’ USDG. Stablecoins are a network effect business and therefore sacrificing a lot in the short-term will have excellent long-term payoffs.

I believe current issuers are discounting the competitive forces of Qivalis slightly too heavily. Unlike Eurite and EUROD, the issuance will be from a separate & independent EMI, not a division within a credit institution, and therefore the internal debates regarding LCR transformation do not exert similar pressures as in those two institutions. LCR transformation refers to the need of a bank to hold more high-quality liquid assets at hand when they issue a stablecoin and cannot identify the stablecoin holders than when maintaining the same funds as retail deposits. More about that here.

Qivalis is also better positioned from a risk management perspective than any other issuer. Assuming they have immediate access to 10 different credit institutions, they could trivially split the reserves to 3% slices at each participating bank – this instead of holding 30% of the reserves at Banking Circle. That’s an underappreciated and a very strong selling point.

The more you think about it, absent a catastrophic failure to move with speed, winning against Qivalis may be almost impossible in the medium/long-term. The only viable competition is any social network or business with huge distribution capabilities. Issuers should therefore really consider if they should target some certain niche or if they have the capability to outperform in speed/agility/risk-tolerance.

2026 will be the most interesting year so far. I have a glimmer of hope that Euro stablecoin growth might also finally outperform USD growth.

Key Takeaways

Future is brighter. EUR/USD FX rates reminded Europeans to the risks of hodling in non-native currency. Euros are becoming part of DeFi.

Here’s what various folks should have in mind going into 2026 to enable a thriving European, euro-stablecoin ecosystem:

- Central banks: aggressively pursue the ability for issuers to maintain reserves directly as CB balances

- Banks: join an issuer partner network now – stablecoins are here to stay and the time to move to get more than just scraps is now

- FinTechs: stablecoins can increase money velocity and reduce financing costs, look into them as a serious alternative

- Wallet providers: make your product available in euros so that access for normie Europeans is less scary

- Euro stablecoin issuers: raise as much capital as you can, you’ll need it to grow. Rethink your GTM strategy.

- Market makers: generalist FX rates will not do, put resources into understanding how you can bring down EUR/USD spreads to stay competitive – if you are quoting more than 2bp for half a mil, you will go out of business

- Policy makers: reduce the issuer CET1 requirements significantly – they hurts EUR issuers disproprtionatly, making Euro issuance less interesting than USD issuance. Stablecoins do not have a similar risk profile as banks do.

- Those thinking of building in the space: Do it now. There’s momentum yet it’s still early. Now’s the time to become a meaningful money-lego for the future of euros.

Closing Notes

Thank you for joining me on this tour de stable! If you found this piece helpful or informational, please share it with your network. You can also follow me on LinkedIn or Twitter and subscribe for updates on my writings below.

If you’d like to continue the discussion about onchain euros, we have a Telegram group titled “BRING EUROS ON CHAIN”. You can join it here.

Thanks to everyone who took time to chat with me in preparation to writing this piece.

PS: Check out my new Euro Stablecoins Dashboard to find other interesting statistics on onchain euros!

All markets and numerical data have been compiled over the second half of December 2025. If you think some of the data presented herein is false or inaccurate, please DM me and we’ll get it fixed. All currency conversions have been completed using the relevant day’s rate.

Recommended Reading

Still looking for more? Here are a few good foundational pieces to read in order to understand euro stablecoins:

Issuance and regulation

- MiCA, Title IV (The defining regulation for EMTs)

- View on multi-jurisdictional issuance – European Credit Research Institute

Relationships to existing financial systems

Interoperability

- Central bank money as a catalyst for fungibility: the case of stablecoins – ECB Working Paper Series

Current state of euro stablecoins

Relevant non-euro stablecoin related reading

- Stablecoin adoption is an incentives design problem – Chuk Okpalugo

- Assume The Position (brief history and views on distribution) – Arthur Hayes

- State of Crypto: Stablecoins went mainstream – a16zcrypto

Relevant non-stablecoin related reading

Relevant macro-issues and perspectives These articles should be read extremely critically; they may be more an insight into the author’s view and/or lack of understanding of next-gen stablecoin-proliferated financial system than anything else

- Resisting deregulation: safeguarding bank resilience in an evolving financial landscape – ECB

- Bastille Day (on the future disintegration of the euro) – Arthur Hayes

Appendix: List of Euro Stablecoin Issuers

Please note that this table may be updated from time to time and does not necessarily reflect the state at end of 2025.

| Issuer↑ | Ticker↕ | HQ↕ | Auth.↕ | Backing↕ | Chains↕ | Supply↕ | Status↕ | Socials |

|---|---|---|---|---|---|---|---|---|

| 3A DAO | EURO3 | MH | None | CDP | 2 | - | ⚪ | in 𝕏 |

| AIEU Services Limited S.A. | BREUR | LU | MiCA: EMI | Fiat | 1 | - | ⚪ | |

| AllUnity GmbH | EURAU | DE | MiCA: EMI | Fiat | 5 | - | 🟢 | in 𝕏 |

| Ambr Payments, UAB | - | LT | MiCA: EMI | Fiat | - | - | ⚪ | |

| Anchored Coins AG | AEUR | CH | Self-regulatory | Fiat | 2 | - | 🟢 | |

| Angle | EURA | VG | None | CDP | 14 | - | 🟡 | 𝕏 |

| Aryze | eEUR | DK | None | - | 14 | - | 🟢 | in 𝕏 |

| Bancomat | - | IT | - | - | - | - | 📣 | |

| Banking Circle S.A. | EURI | LU | MiCA: CI | Fiat | 2 | - | 🟢 | in 𝕏 |

| Circle Internet Financial Europe SAS | EURC | FR/US | MiCA: EMI | Fiat | 6 | - | 🟢 | in 𝕏 |

| EURST | EURST | - | None | - | 1 | - | 🔴 | 𝕏 |

| Fiat Republic Netherlands | ENEUR | NL | MiCA: EMI | Fiat | 1 | - | ⚪ | 𝕏 |

| Heuro SAS | HEURO | FR | MiCA: EMI | Fiat | 2 | - | ⚪ | in 𝕏 |

| Iron Bank | IBEUR | - | None | CDP | 1 | - | 💀 | |

| Jarvis | jEUR | KY | None | CDP | 8 | - | 🟢 | 𝕏 |

| Lugh | EURL | FR | None | Fiat | 1 | - | 🔴 | |

| Mento Labs | EURm | US | None | CDP | 1 | - | 🟢 | 𝕏 |

| Monerium ehf. | EURe | IS | MiCA: EMI | Fiat | 6 | - | 🟢 | in 𝕏 |

| Newrails UAB | EURW | LT | MiCA: EMI | Fiat | 2 | - | ⚪ | in 𝕏 |

| Oddo BHF SCA | EUROD | FR | MiCA: CI | Fiat | 1 | - | 🟢 | in |

| Parallel / MIMO Capital | PAR | - | None | CDP | 3 | - | 🟢 | 𝕏 |

| Paxos Issuance Europe Oy | EUROe | FI/US | MiCA: EMI | Fiat | 7 | - | 🟡 | in 𝕏 |

| Qivalis | - | NL | MiCA: EMI | Fiat | - | - | 📣 | in 𝕏 |

| Quantoz Payments B.V. | EURQ, EURD | NL | MiCA: EMI | Fiat | 4 | - | 🟢 | in 𝕏 |

| STABILLON SP. Z O.O. | - | PL | MiCA: EMI | Fiat | - | - | ⚪ | in |

| STSS (Malta) Limited | EURS | MT | None | Fiat | 1 | - | 🟢 | 𝕏 |

| Salvus SAS | EUROP | FR | MiCA: EMI | Fiat | 5 | - | 🟢 | in |

| Société Générale - Forge | EURCV | FR | MiCA: EMI | Fiat | 4 | - | 🟢 | |

| StablR Ltd | EurR | MT | MiCA: EMI | Fiat | 3 | - | 🟢 | in 𝕏 |

| Stable mint Ltd | EURSM | MT | MiCA: EMI | Fiat | 2 | - | ⚪ | in |

| Synthetix | SEUR | - | None | Algo | 1 | - | 💀 | |

| Tether | EURT | SV | None | Fiat | 1 | - | 🟡 | 𝕏 |

| The Standard | EUROs | - | None | CDP | 2 | - | ⚪ | in 𝕏 |

| UAB BLUE EMI LT | BLUEUR | LT | MiCA: EMI | Fiat | 1 | - | 🟢 | |

| Usual Money | EUR0 | FR | None | CDP | 1 | - | 🟢 | 𝕏 |

| VNX | VEUR | LI | Other | Fiat | 14 | - | 🟢 | in 𝕏 |

| decentralized EURO Association | dEURO | - | None | CDP | 1 | - | 🟢 | in 𝕏 |

| xMoney | EURXM | RO | MiCA: EMI | Fiat | 3 | - | 📣 | 𝕏 |

Status: 🟢 Live · 🟡 Wind down · 📣 Announced · ⚪ Unknown · 🔴 Terminated · 💀 Defunct